Marriage tax calculator

A New Marriage Penalty for High Earning Couplesand a Bonus for Some. Married Couples are missing out on up to 1188 MARRIAGE TAX CALCULATOR 1 ELIGIBILITY2 DECISION3 INCOME4 PERSONAL5 SIGN Youre just seconds away from.

How To Calculate 2019 Federal Income Withhold Manually

You can use this calculator to work out if you qualify for Married Couples Allowance and how much you might get.

. You will pay an additional 09 Medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly and 125000 married filing. California taxable income Enter line 19 of 2021 Form 540 or Form. Our new Marriage Bonus and Penalty calculator despite all its Valentines Day finery ignores the new 09.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. You need to be. Start filing your tax return.

For example a 500000 home in San Francisco taxed at a rate of 1159 translates to a payment of 5795. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. Their partner can still.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Our income tax calculator calculates your federal state and local taxes based on several key inputs. This means that youll pay 186 more if you are married than if you are not.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators. Your household income location filing status and number of personal. Marriage Allowance lets you transfer 1260 of your Personal Allowance to your husband wife or civil partner.

This reduces their tax by up to 252 in the tax year 6 April to 5. Marriage Allowance Calculator. Qualifying widow er with dependent child.

Calculate your Married Couples Allowance. Updated to include income tax calculations for 2021 form 1040 and 2022 Estimated form 1040-ES for status Single Married Filing Jointly Married Filing Separately or Head of Household. Effective tax rate 172.

My Marriage Tax is a trading style of Tax Claim Helpdesk Ltd a company registered in Ireland under registration number 715592. In 2020-21 people earning between 11251 and 12499 can still transfer 1250 of allowance but will become liable to pay tax on any income in excess of 11250. Your household income location filing status and number of personal.

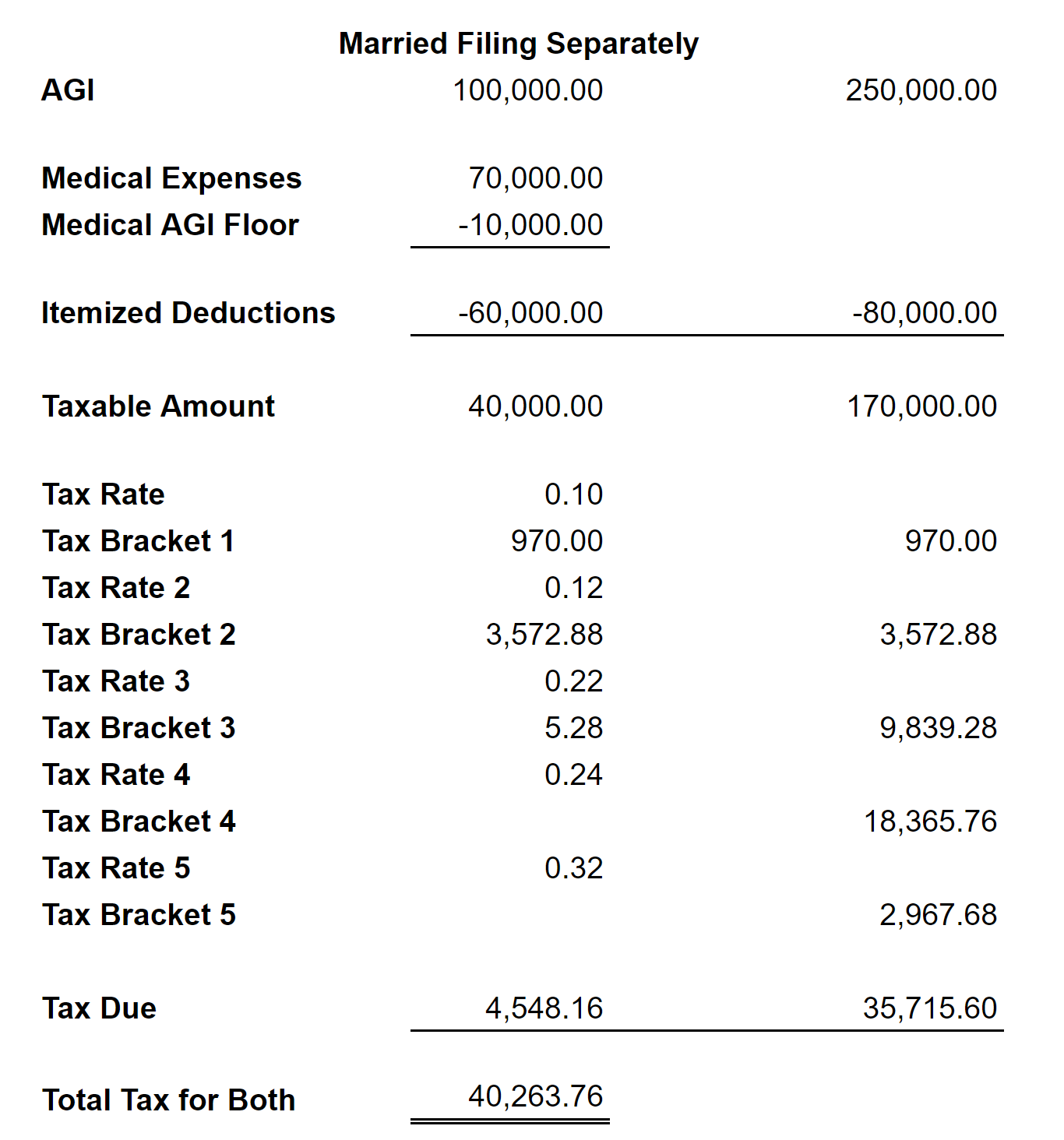

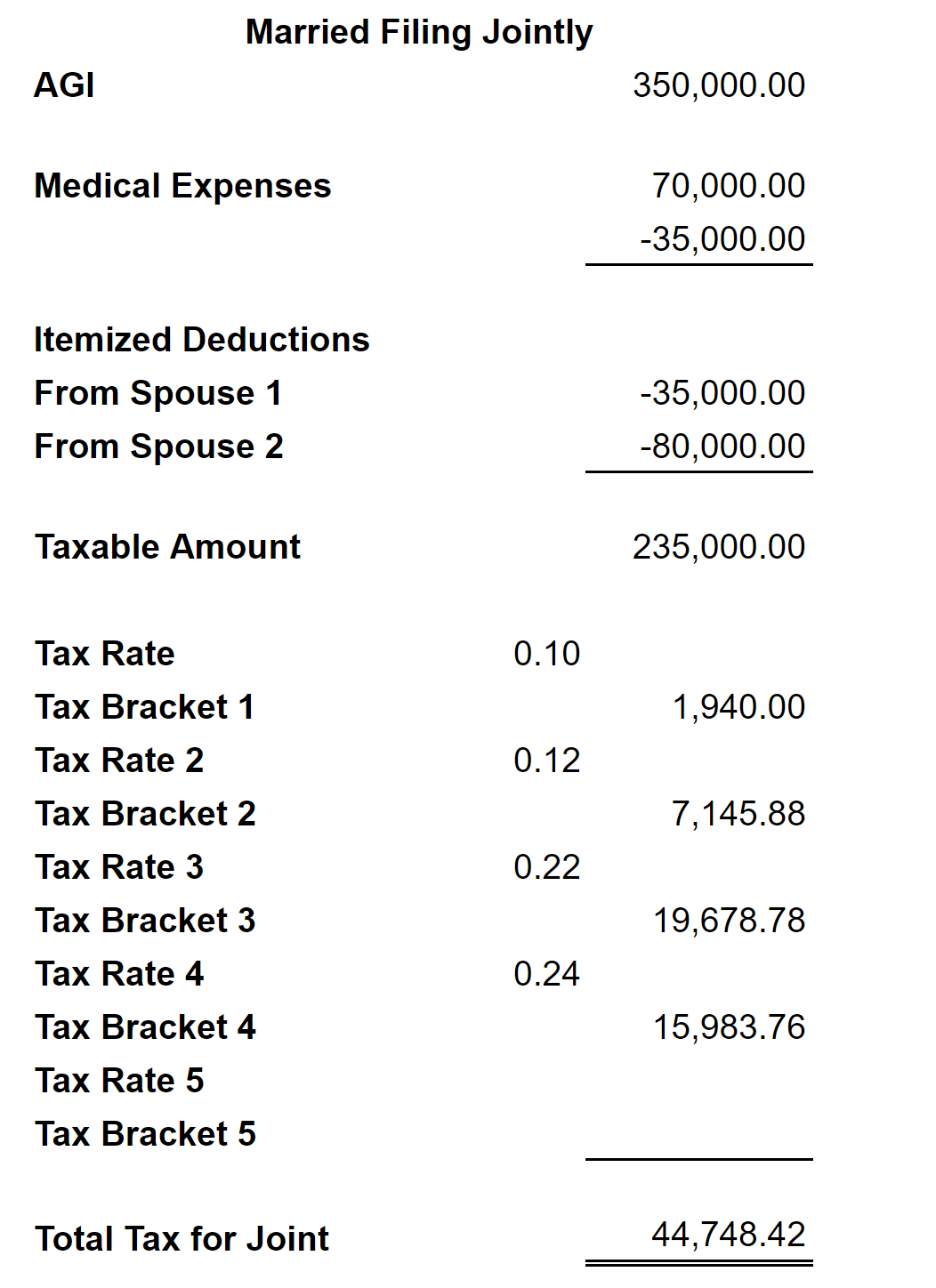

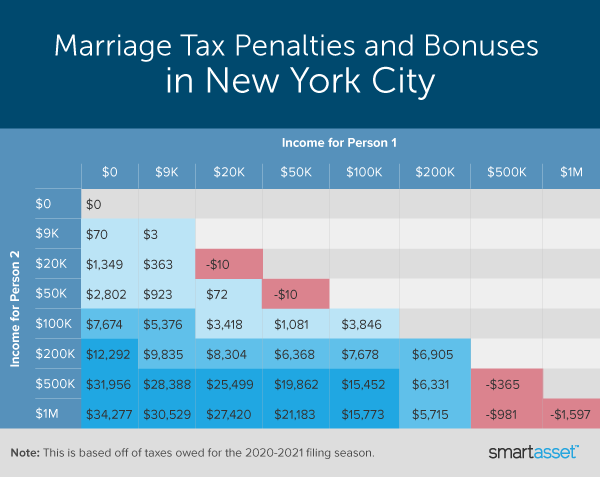

This tax is a percentage of a homes assessed value and varies by area. By submitting your details. A couple pays a marriage penalty if the partners pay more income tax as a married couple than they would pay as unmarried individuals.

Home financial income tax calculator.

Tax Calculator Estimate Your Income Tax For 2022 Free

How To Calculate Federal Income Tax

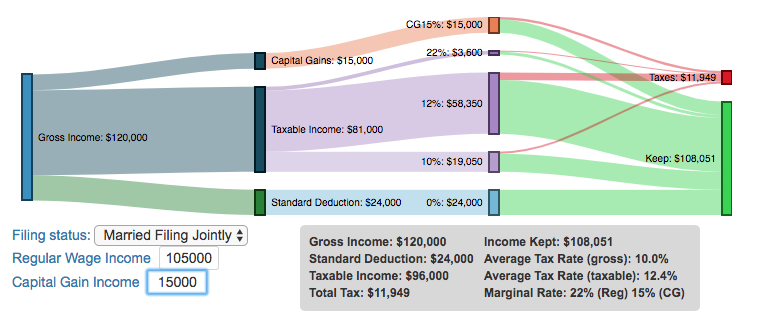

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

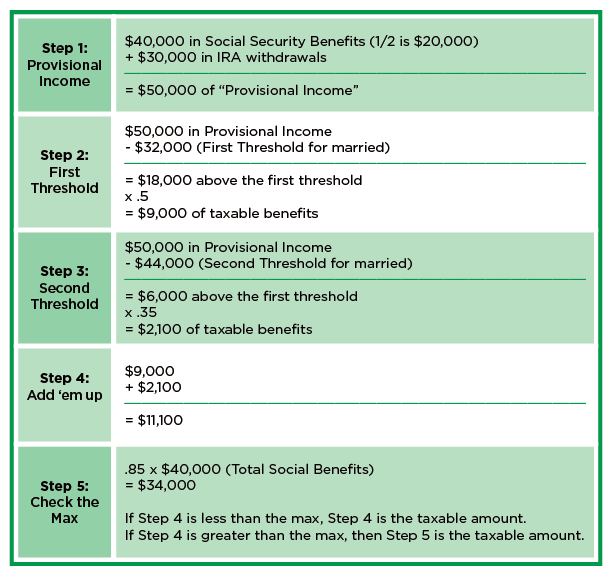

Taxable Social Security Calculator

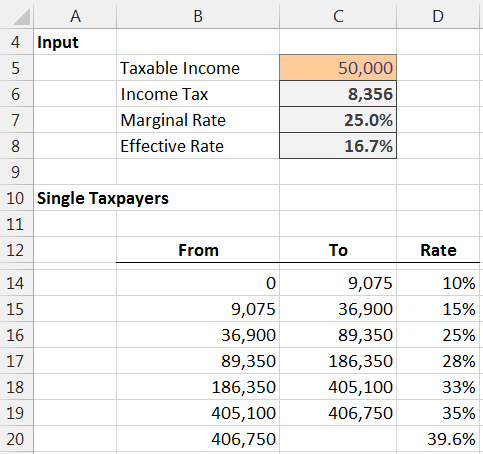

Income Tax Formula Excel University

Income Tax Formula Excel University

Can A Married Person File Taxes Without Their Spouse

Can A Married Person File Taxes Without Their Spouse

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

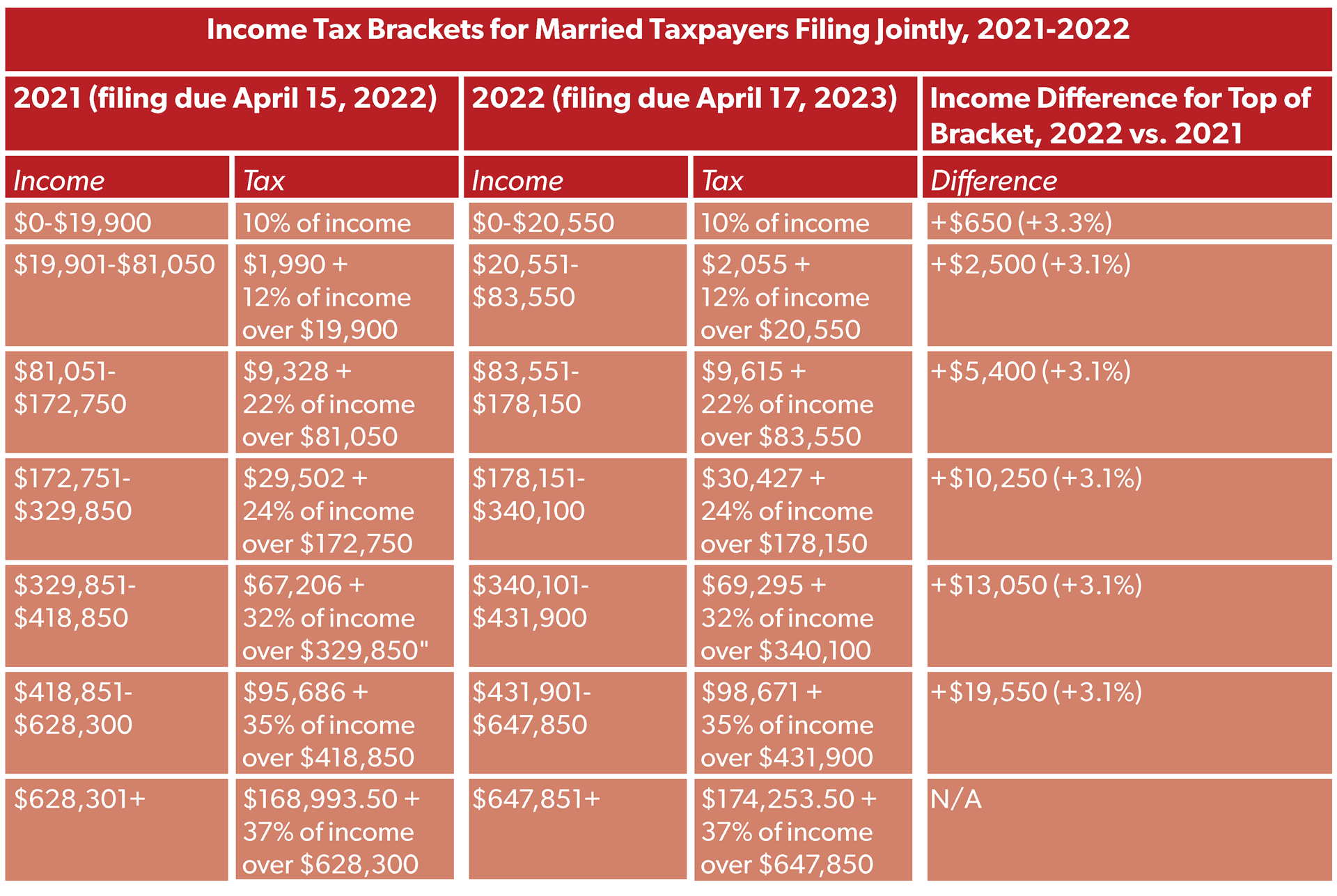

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

What Are Marriage Penalties And Bonuses Tax Policy Center

Marriage Penalty Vs Marriage Bonus How Taxes Work

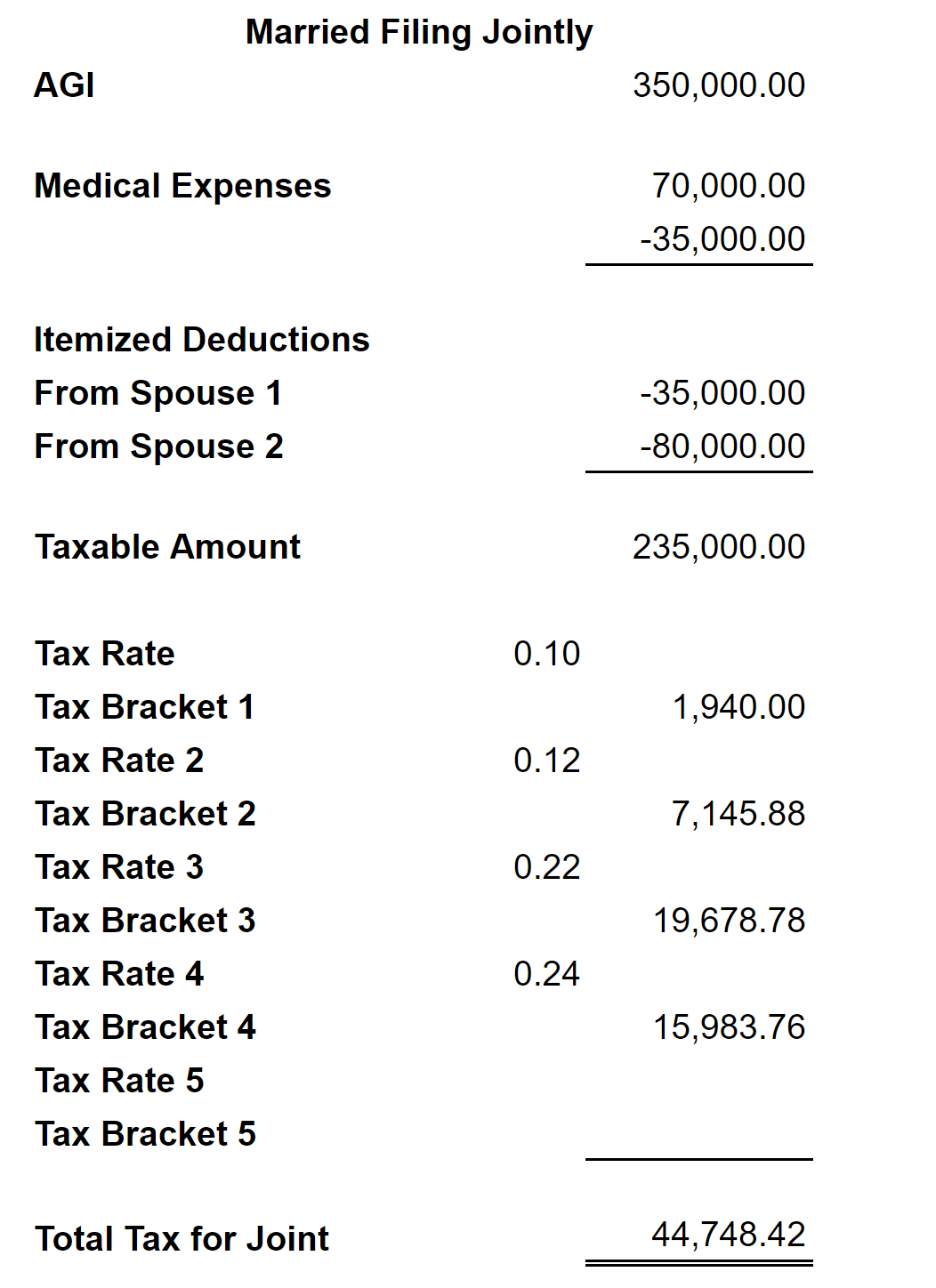

Will You Pay More Or Less Taxes When You Get Married Spreadsheetsolving

Will You Pay More Or Less Taxes When You Get Married Spreadsheetsolving

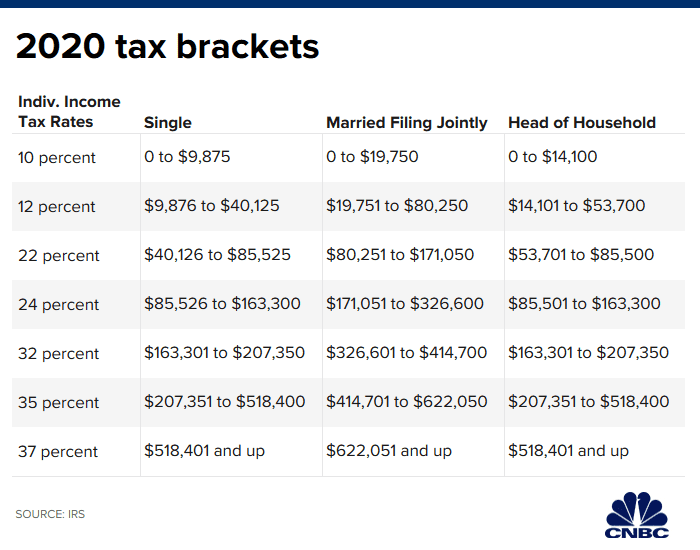

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download